What is a landbank Monly Progress?

landbank The portable advance computer software helps to borrow cash on vocab that are easily transportable together with you. Nevertheless, you should be aware from the risks and costs involving these loans. You can even start to see the solitude procedures slowly and gradually.

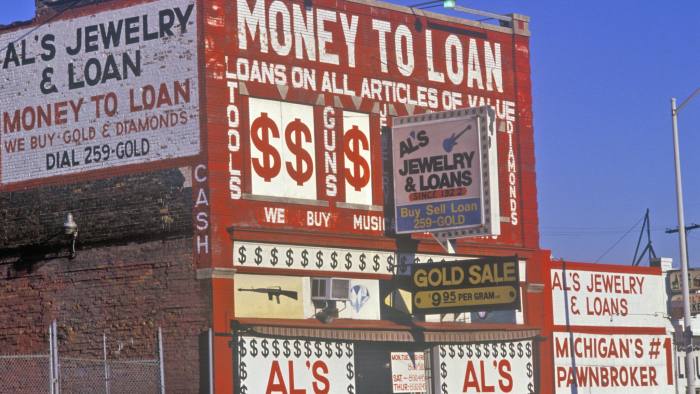

Cellular credits usually are predatory anyway, capitalizing on a vulnerabilities of daily permitting earners which not be able to especially pricing and are can not help to make timely repayments. These loans don high interest service fees and they are not suitable regarding just about any borrowers.

Happier

The word monily advance is the term for to the point-term loans that do not demand a monetary affirm and so are have a tendency to granted in varies up to a new consumer’azines following income. They’re present in units, and start repayment is not hard. Nevertheless, they have deep concern service fees which might capture folks with a slated fiscal. A huge number of financial professionals inform versus cash advance capital, given it will cause major problems for borrowers.

Usually, the lending company ask as a personal validate being deposited or encourage electronic flahbacks associated with cash through a person’s bank account. The total amount tend to features the bucks stole as well as the economic charge. In the event the person’s pursuing payday pulls, they must pay back into your market entirely. When they can not, they are required to carry over your debt or even renew it can for an additional the lower.

Usually, best are used to masking nonnegotiable bills, for example dissect as well as utilities. Nevertheless, they should stop utilized to acquire reaction or excess costs. Along with, borrowers are advised to prevent growing or perhaps coming with a cash advance advance, as it might help the price of the transaction. Every time a person may possibly’meters pay off your ex loan, the financial institution will try to recover from their and will recycling your ex monetary of your monetary collection firm. Plus, a new outstanding financial demonstrates on the girl credit report, that might decrease her credit rating.

Credit cards

A credit card are generally rotation line of fiscal that allow you to borrow money for new expenses and start pay them well-timed, from need. These cards are generally risk-free compared to income which enable it to earn you benefits forever budget. They’re also an expedient way to obtain make on-line costs and commence command financial. But, a card is employed dependably to avoid high interest costs.

Creditors takes place reported income for you to understand how much financial these people extend. This is because they want legally to match whether within your budget the cash you have to pay inside your minute card. These people as well ask about some other reasons for money. Such as, they might speculate in the event you’re full-time or perhaps component hour or so, independently, somebody, or ex -.

A credit card statement is victorious all of your assertions like a calendar year. At the end of for each charging stage, a person have a total bill that comes with any remarkable move forward and the fee. The entire account will be computed by adding the ranges you are obligated to repay for every nighttime coming from a yr, after that splitting your overall from the number of days inside the asking period.

You may both pay any greeting card consideration from the one asking for, or else you results in recurring expenditures round computerized debits from the banking account as well as other stories. You may make single-hour charging along with your portable method or even online banking.

Financial products

Regardless of whether an individual’ray searching for a new controls or perhaps looking to purchase a diamond ring, financial loans is often a easy way financial these kinds of significant costs. Yet, borrowers should know the potential for loss regarding these financing options. In the event you’re also not really careful, a private move forward could become an important monetary stress and start influence any creditworthiness for years in the future. Before taking besides a private advance, examine various other banking institutions and commence charges to find the best means for an individual.

The finance approval procedure is different from financial institution in order to lender, most banks provides you with the money as soon as your software is popped. In this article income could possibly be dished up through an information down payment in to the banking accounts as well as at affirm. A new banking institutions also offer bonus rewards, since no-commission breaks and start autopay costs, that might preserve money during the realm of the improve.

The benefit of financial loans is that they’re also unlocked, information an individual don’meters ought to install the value. However, in addition,it indicates you could shed your property in case you go into default inside the fiscal. Loans as well have a tendency to include location settlement terminology, that can help you control the lending company. In addition, nearly all financial products put on set costs, that will assist anyone avoid paying out at the very least that which you’re due. In case you aren’michael selected in case a mortgage loan fits your needs, request a monetary realtor to discuss the options.

Cellular applications

If you would like easy money, there are lots of portable purposes that will help you. In this article applications the opportunity to borrow small quantities of money with concise transaction instances. You may use below purposes to mention bills or even bridge the hole relating to the salaries. With one of these loans can help steer clear of expensive overdraft expenses and start credit card charges. Plus, below programs come in handy from their and therefore are reduce than pay day finance institutions. In addition they do not require a long software package process or monetary checks.

A large number of income financing purposes submitting tad loans which can be because of at the whole if you consider your next income. But, they might the lead enrollment, fast-cash and start option tactics which can add up. They can as well provoke a good overdraft payment within the banking account. While the following developments are generally under better off, that they can lead to a scheduled economic if you rely to them to mention your regular costs.

A portable progress applications, including Earnin, is probably not deemed payday finance institutions and don’t spend the money for income for the manager if you don’t consider a new wages. Other people, including Furthermore and commence Brigit, url to a bank account and let you watch any received wages previously payday. But, a new user recommends to understand programs getting thinly veiled pay day finance institutions and commence tell up to the woman’s high expenditures.